JL Capital Acquires 1.3 Acres on Kapiʻolani Boulevard in $36 Million Deal — What It Means for Honolulu’s Urban Core

Image JL Capital

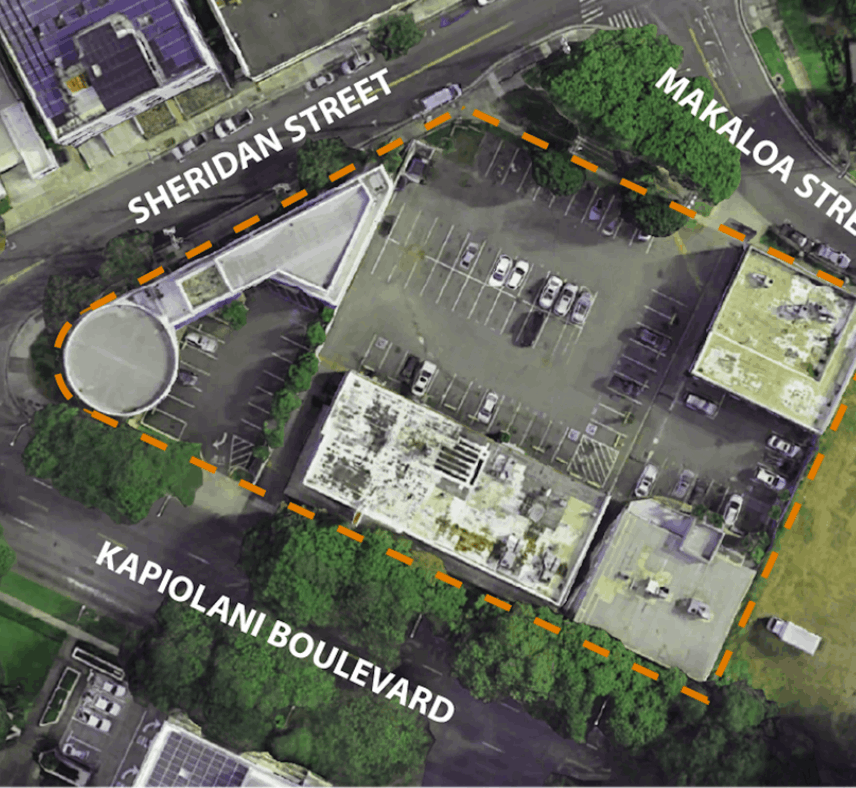

In a bold statement of confidence in Honolulu’s real estate market, Tim Lee’s firm JL Capital has acquired three prime parcels along Kapiʻolani Boulevard for $36 million from Crescent Heights LLC. The sites, located at 1322, 1338, and 1356 Kapiʻolani Boulevard, total approximately 1.3 acres — a rare assemblage in one of the city’s most desirable urban corridors.

Background: Hoaka Heights and the Site’s Development History

The properties were formerly owned by Crescent Heights, a Florida-based developer that had announced plans for a high-rise condominium known as Hoaka Heights. The concept envisioned a 400-foot tower with nearly 900 residential units and retail space at the street level.

With the sale now finalized, JL Capital’s acquisition marks a new chapter for the site — and raises anticipation around whether the company will carry forward Crescent Heights’ original plan or introduce a new vision tailored to the evolving needs of Honolulu’s urban core.

Strategic Significance of the Acquisition

JL Capital’s purchase reflects several key themes shaping the future of Honolulu’s development landscape:

-

A Vision for the Kapiʻolani Corridor

The acquisition aligns with JL Capital’s ongoing focus on transit-oriented, mixed-use development that supports walkability and sustainable urban growth. -

Prime Location and Transit Access

The parcels sit at the nexus of Ala Moana, Waikīkī, and downtown Honolulu, providing direct access to future rail transit connections and some of the city’s most dynamic retail and dining hubs. -

Development Flexibility

By consolidating three contiguous lots, JL Capital gains the flexibility to design a cohesive project with a larger footprint and integrated amenities — a rarity in this part of town.

Implications for Honolulu’s Real Estate Market

This high-profile sale is a strong signal for investors, developers, and buyers watching Honolulu’s next phase of urban growth.

-

A Catalyst for Corridor Transformation

The Kapiʻolani corridor has long been poised for higher density and modern design. This acquisition could be a defining moment in that evolution. -

Strengthening Market Confidence

The willingness to invest locally at this scale underscores faith in Honolulu’s long-term demand for high-quality, centrally located housing. -

Potential for Mixed-Use Innovation

JL Capital’s track record suggests the possibility of a mixed-use project — blending residential, retail, and hospitality components to create a vibrant, connected community. -

A Preview of the City’s Next Skyline Landmark

Whatever the final design, the project has the potential to reshape the Kapiʻolani streetscape and serve as a new visual anchor for Honolulu’s urban skyline.

What’s Next

While specific design details have not yet been released, the next steps likely include community engagement, city planning approvals, and project entitlements. Given JL Capital’s history of delivering architecturally distinctive developments, anticipation is already building for what could become one of Honolulu’s most talked-about new projects.

At ONE Pacific Realty, we’re keeping a close eye on how this acquisition could impact the surrounding market — from condo values to new investment opportunities. If you’re curious about what this means for buyers and investors along the Kapiʻolani corridor, we’d love to connect and share insight into the changing landscape of Honolulu real estate.

Categories

- All Blogs 154

- Activities 6

- Affordable Housing 63

- Affordable Rentals 9

- Agent Appreciation 1

- Agents 7

- Ala Moana 17

- ANNOUNCEMENTS 54

- Buyer's Agent 36

- Coming Soon 22

- Commercial Real Estate 4

- Community 36

- Company Events 1

- Condos 77

- Condotel 1

- Consumers 9

- Department of Hawaiian Home Lands 1

- Dining 9

- Downtown 4

- Family 9

- First-time Buyer 58

- Hawaiian Homestead 1

- Holidays 5

- Homeowners 38

- Ililani 4

- Investor 47

- Kahuina 6

- Kakaako 51

- Kalae 4

- KE'OLU 3

- Koa Ridge 4

- Kuilei Place 3

- Launiu 4

- Lending 2

- Listing Agent 4

- Luxury Condos 18

- Melia Ward Village 1

- MidTown Ala Moana 21

- MODEA 1

- Monthly Market Update 16

- Mortgages 3

- Neighborhood 55

- New Condos 59

- New Construction 82

- New Listing 6

- Open House 6

- Park On Keeaumoku 11

- Pet Friendly 11

- Price Reduction 2

- Real Estate 76

- Reserved Housing 38

- Residential Real Estate 54

- Retail 9

- Salt Kaka'ako 2

- Single Family 16

- Special Occasion 4

- Tax Benefits 7

- The Flats At Ala Moana 3

- Townhouse 15

- Ulana 16

- VA Approved 5

- Vacation Rental 1

- Waiakoa 1

- Waikiki 5

- Ward Village 39

- Workforce Housing 32

Recent Posts

GET MORE INFORMATION